Overview of AI valuation

Overview

- Non-marketable securities valuation is a service that allows clients to fulfill their needs depending on various situations such as absence of active markets, inheritance of non-marketable securities, transfer of securities and valuation of specific assets. This process strictly follows our currently accepted K-IFRS 1039(Financial Instruments: Recognition and Measurement) and No. 1113(Fair Value Valuation).

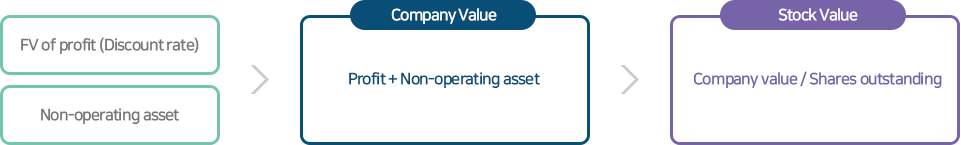

- We mainly use the Discounted Cash Flow, or DCF, approach to value nonmarketable securities, and oftentimes incorporate other valuation methodologies like market-based approach and asset-based approach to calculate fair value of a security.

Our proud footprints

- Korea Asset Pricing has accumulated a wide range of experience and unmatched reputation by valuing over 18,000 non-marketable securities from non-marketable securities valuation to securities applied to the inheritance tax law.

- We provide trustworthy service to our clients. Our valuation coverage in securities markets reaches from KOSDAQ listed companies that hold nonmarketable securities, creditors(banks and companies) that possess sales restricted stock/share to investment management companies and FB&A divisions within a company that manage such securities.

- We are No.1 in non-marketable securities valuation, and are unmatched when it comes to quality and excellence in our service.

- We provide superior service to our clients in a timely manner such as valuation reports in accordance with K-IFRS, internal and external audit support, and valuation back-data when necessary.

Our Valuation Approach

Bottom-Up Approach

- Categorizing target companies by size and industry to select the most reasonable valuation model

- Breaking down complex securities(options, warrants etc) to individual underlying assets. → Valuation of those individual underlying assets

Statistical and Scientific Approach

- Valuation based on the weighted average applied financial models by industry and size

- Valuation based on key indicators such as growth rates to derive price distribution

Thorough Verification

- Verifying the robustness of valued price

- Validating the final product through third-party network

Key Considerations

- KAP has a series of valuation models that can be applied to specific companies under specific conditions.