Valuation

- Nonmarketable Securities Valuation

- Funds and PEF securities

- Goodwill, PPA

- PFV, SOC

- Venture Company

- NPL

Overview

- Non-marketable securities valuation is a service that allows clients to fulfill their needs depending on various situations such as absence of active markets, inheritance of non-marketable securities, transfer of securities and valuation of specific assets. This process is strictly dictated by currently accepted K-IFRS 1039(Financial Instruments: Recognition and Measurement).

- Korea Asset Pricing has accumulated a wide range of experience and unmatched reputation by valuing over 18,000 non-marketable securities from virtually every bank in Korea.

Excellence in Service

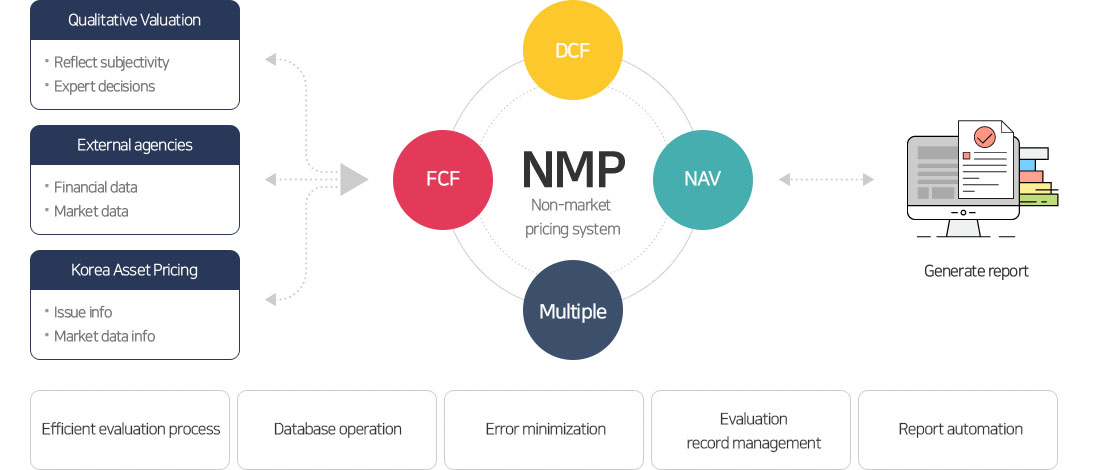

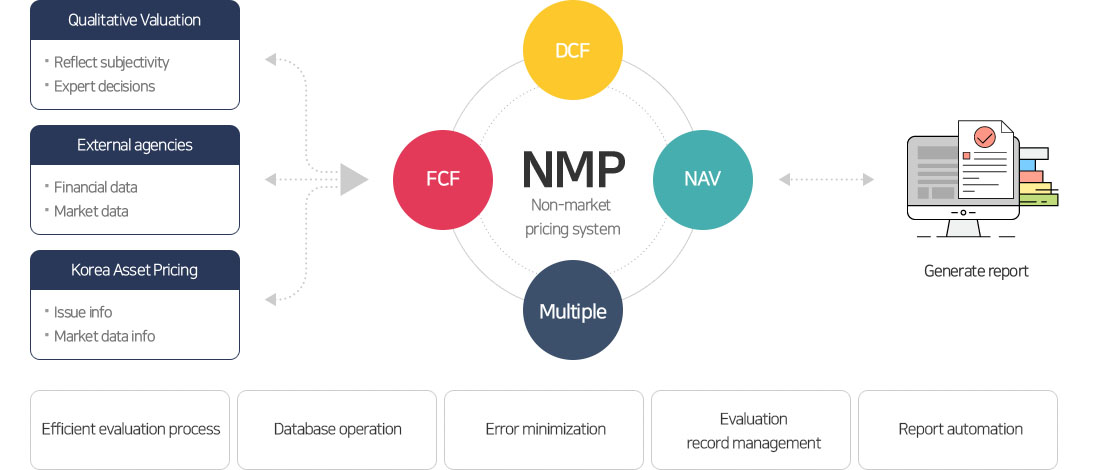

- KAP has developed a unique pricing system known as NMEPS: Non-Marketable Equity Pricing System to organize and operate financial DBs, financial models and valuation reports.

PROCESS / Methodology

PROCESS

- We adopted FSS-recommended Non-marketable securities valuation process as our internal valuation system to enhance speed, accuracy, and fairness of our valuation process.

-

- Collection of reported data, metric and nonmetric data

- Thorough review of data

-

- Market/industry analysis

- Target company analysis

- Set basic hypothesis

-

- Analysis of past financial data

- Modification of data when needed

-

- Company and peer group rating analysis

- Set discount rate

- PF, SOC feasibility analysis

-

- Select best fit model

- Calculate expected value based on the model

-

- Calculate fair value

- Verify and receive

- Follow-up check

-

- Write report

- Submit report

Methodology

- We have numerous financial models that can be used for nonmarketable securities valuation, and we select the most reasonable model for each target companies.

| Approach | Methodology | Description |

|---|---|---|

| Profit based approach | Free Cash Flow to the Firm(FCFF) | Most widely used method when valuing nonmarketable securities. |

| Free Cash Flow to Equity(FCFE) | Used to estimate company with financial P/L recognized as Operating gain/expense | |

| Dividend Discount Model(DDM) | Used to estimate firm whose dividend cash flows are stable or readily assumable. | |

| Option Pricing Model(OPM) | Used to estimate newly-established firm or venture business whose future cash flow is unstable | |

| Economic Value Added(EVA) | Used to estimate diversified firms who have well-diversified portfolio | |

| Discounted Surplus Profit | Used to estimate firms without dividends | |

| Market Based Approach | Comparative Company Analysis |

|

| Asset Based Approach | Net Asset Value(NAV) |

|

Additional Services

- Internal and external audit support service

- Provide valuation related back data and other DB

- Open informational sessions when necessary

Overview

- Funds and PEF are collective investment scheme used for making investments in various equity(assets) securities in which residual income generated from that investment is distributed to investors on a pro rata basis.

Services

| Category | Characteristics |

|---|---|

| PEF | A private equity fund is raised and managed by investment professionals of a specific private equity firm. The professionals will typically manage target company by raising its value through restructuring, business management etc and will attempt to incorporate various strategies like M&A and IPO to generate profit and distribute them amongst investors. |

| VC | VC is a form of financing that is provided by firms of funds to small, early-stage, emerging firms that are deemed to have high growth potential with substantial risk. An investor needs to take various factors into consideration when investing such as potential growth rate, additional funds raised, breakeven point, trends, quantity/quality and external factors of innovative technology or business model. |

| CRC | CRC aims to acquire insolvent companies and maximize its value through acquisitions and normalization of management, restructuring, sale of nonperforming bonds, inter-company acquisitions, merger, petition and bankruptcy intermediation. |

PROCESS / Methodology

PROCESS

Methodology

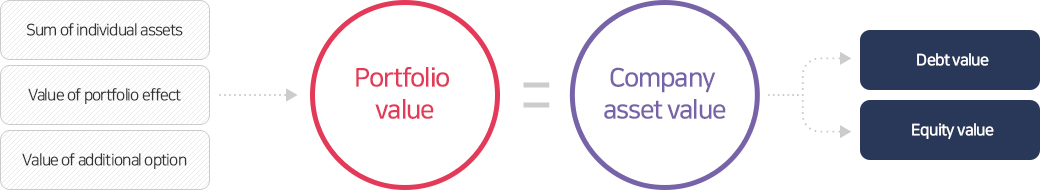

- NAV(or Portfolio Valuation Model) : The asset value of a company is the value of the portfolio effect (synergy effect) that reflects the total sum of individual asset values, and the value of equity capital is the value obtained by subtracting debt from asset.

- Calculate net asset value based on the estimated fair value through the post-analysis valuation model of the underlying assets (common stock, RCPS, BW, CB etc.) to be invested by the investment union and PEF, and finally calculate value per unit.

Intangible asset valuation under K-IFRS

Overview

- Under IFRS, asset and liability after consolidation are both recognized at fair value and any amount exceeding the fair value is recognized as goodwill.

Fair value through consolidation includes not only the target company’s tangible asset, inventories but also intangible assets contributing to company’s growth.

Services

Intangible assets occurring from legal issues or separable entities are also recognized at fair value.

We name the aforementioned valuation method as PPA(Purchase Price Allocation).

We name the aforementioned valuation method as PPA(Purchase Price Allocation).

PROCESS / Methodology

PROCESS

- Under the “assessment of intangible assets and valuation techniques and goodwill impairment after consolidation”, we use PPA(Purchase Price Allocation) to estimate the fair value of intangible asset that should be recognized after business combination.

Methodology

| Approach | Description |

|---|---|

| Market-based approach |

|

| Cost-based approach |

|

| Income-based approach |

|

Intangible Asset valuation under K-IFTS after business combination

Overview

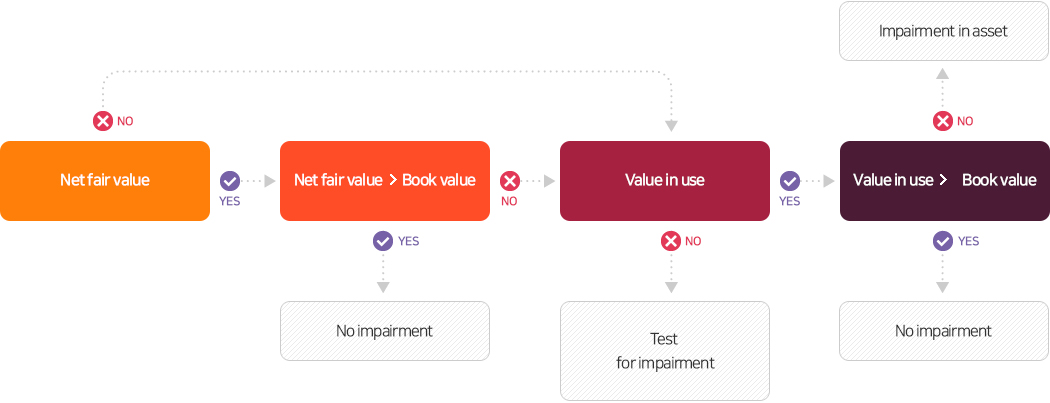

- Goodwill is the amount over the net fair value of identifiable assets, liabilities and contingent liabilities acquired at the cost of the business combination over the share of the acquirer.

In other words, the process of recognizing intangible assets and goodwill in a business combination involves recognizing intangible assets that satisfy the terms of the contractual, legal and separable criteria, and evaluating the remaining residual value as goodwill. Goodwill acquired subsequent to the business combination should be tested annually for impairment.

Services

K-IFRS 1036, "Impairment of assets" requires the use of either the fair value less costs to sell or the value in use. Therefore, in assessing impairment of goodwill, the fair value of cash- generating units or groups of cash - generating units if either the fair value or the value in use exceeds the carrying amount, it is determined that asset impairment does not occur.

PROCESS / Methodology

PROCESS

Methodology

| Approach | Description |

|---|---|

| Income Approach | DCF(K-IFRS 1036 BCZ 16) |

| Market Approach |

|

PFV

Overview

- Project Financing Vehicle is a temporary paper company established in accordance with corporate tax law in order to solve the problem of double taxation which occurs frequently in project finance, funding risk in real estate development and business risk distribution.

Services

we review the business roadmap, business plan status, land use plan, etc to estimate future cash flows such as pre-sale income and pre-sale cost.

Based on this, we review the possibility of recovering the principal of creditor value and examine the possibility of dividend of shareholder value.

Based on this, we review the possibility of recovering the principal of creditor value and examine the possibility of dividend of shareholder value.

PROCESS / Methodology

Methodology

Income Approach : DCF(DCF : Discounted Cash Flow)

- Value to Shareholders = Present value of expected dividend CF/Number of stocks issued

- Value to Creditors = Present Value of discounted future repayment cash flows

SOC

Overview

- Social Overhead Capital is a system operated by the private sector to build social infrastructures such as roads, schools, and hospitals. SOC combines public functions of the government and private capital and technology to construct public facilities which is then funded by the local government.

Main private investment methods

- The private sector invests funds to build infrastructure and transfer ownership to the government. In return, private entrepreneurs are allowed to use the property for a certain period of time. The private operator operates the facility and recovers the investment cost by collecting fee. It is mainly applied to the facility where the revenue (i.e. tollgates) cash flow is stable.

- Buildings are built with private funds and ownership is transferred to the government. Private management and operation are carried out during the agreement period, and the government pays leasing and usage fees to private operators.

Services

Reivew cash-in and cash-out estimates from start and end of the construction period in order to assess the possibility of repayment on loan.

PROCESS / Methodology

Methodology

- Analyze statements and financial models to estimate all cash inflows (operating income, etc.) and cash outflows (investment costs, etc.) related to investments.

- Estimate shareholder and creditor value using appropriate discount rate based on estimated cash flow.

Income Approach : DCF(DCF : Discounted Cash Flow)

- Value to Shareholders = Present value of expected dividend CF/Number of stocks issued

- Value to Creditors = Present Value of discounted future repayment cash flows

Overview

- Although without a clear definition in place, a venture company is a creative SME that develops advanced technologies and ideas to upgrade business according to its general features; First, Start-ups established by a small number of technology entrepreneurs to commercialize the idea of technological innovation. Second, a company with high risk but also very high return when successful. Third, a company led by exceptionally enthusiastic entrepreneur.

Services

Financial DB designed for nonmarketable securities valuation, NMEPS designed for stock valuation and report generation.

PROCESS / Methodology

Methodology

- reflect characteristics, growth potential, and technical characteristics of venture companies to estimate fair value.

- Utilize discounted cash flow, option valuation model to calculate the fair value of stocks by combining market valuation and asset valuation methods.

Income approach: DCF(DCF : Discounted Cash Flow)

- Stock Value = (EV - debt value) / shares issued = [Σ (FCFFt / (1+WACC)t) + non-business asset value – debt value] / shares issued

- Enterprise Value = Present Value of future cash flow

Overview

- Non-performing loans (NPL) are distressed loans classified as general unsecured bonds, and special bonds (corporate bonds), which has deteriorated conditions since inception.

Services

- The NPL valuation incorporates DCF method, liquidation value approach, and recovery rate method to estimate the future cash flows of nonperforming loans and assess fair value by reflecting appropriate discount rate based on credit risk analysis.

- According to the Capital Market and Financial Investment Business Act, Enforcement Ordinance and Supervisory Regulation of the Act, the asset management company is obliged to evaluate the bad debt or bad assets, which are indirect investment property according to the market price. The valuation agency is limited to the bond valuation company.

PROCESS / Methodology

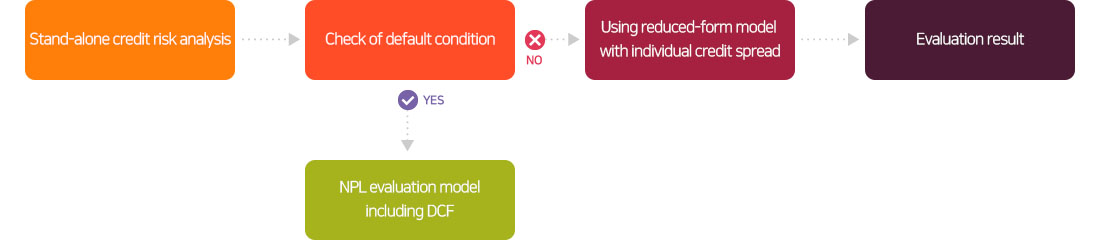

PROCESS

- Surveying recovery rates of individual firm through financial supervisory data, financial statements and due-diligence

- Surveying recovery rates of individual firm through non-performing loan data of financial institutes

- Evaluation with surveyed recovery rates and due diligence of debt in each firm

Methodology

- According to the Capital Market and Financial Investment Business Act, Enforcement Ordinance and Supervisory Regulation of the Act, the asset management company is obliged to evaluate the bad debt or bad assets, which are indirect investment property according to the market price. The valuation agency is limited to the bond valuation company.